Retired Parents and Settled Kids

Are You Ready For These?

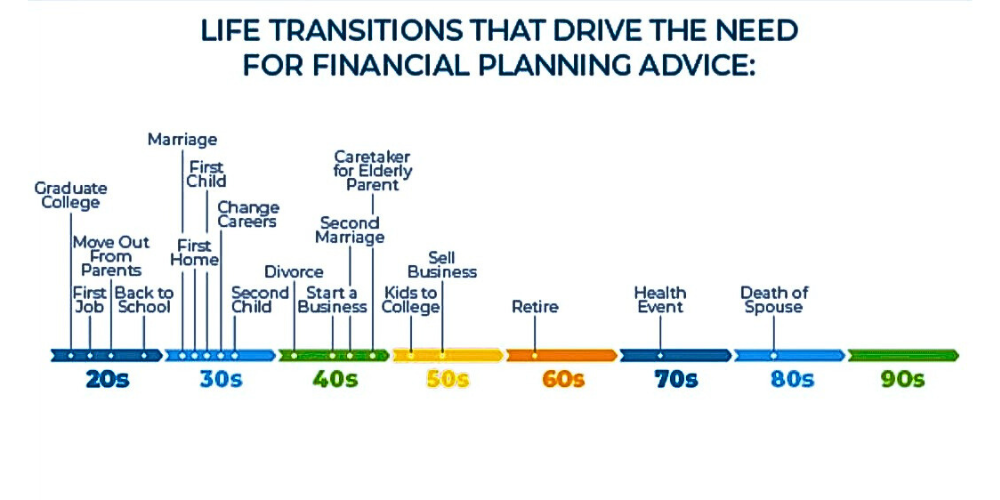

We Work With Individuals and Families in All Phases of Life.

Your personal finances and investments can become overwhelming and complex. At Sampadha, our main goal is to simplify your financial life.

1. Why you need a Financial Plan? A financial plan is essential for retired parents with settled kids because it ensures financial security and peace of mind during retirement years. By creating a comprehensive plan, you can manage your retirement income, expenses, investments, and estate planning to support your desired lifestyle and leave a legacy for your children. Without a plan, you risk outliving your savings or facing financial uncertainty in your later years.

2. Why you need us? We understand that managing finances in retirement can be complex, especially when considering the needs and aspirations of both retired parents and their settled children. Our expertise and experience enable us to develop personalized financial strategies that address the unique challenges and opportunities faced by your family. We provide guidance and support to help you navigate retirement with confidence and clarity.

3. How can we do it for you? Our company offers a range of specialized services tailored to the needs of retired parents with settled kids. We start by conducting a comprehensive assessment of your financial situation, retirement goals, and family dynamics. Based on this assessment, we develop a customized financial plan that considers factors such as retirement income sources, healthcare costs, long-term care needs, estate planning, and intergenerational wealth transfer. Our ongoing support and guidance ensure that your financial plan remains relevant and effective as your circumstances evolve.

4. Why you need it now? It’s crucial to prioritize financial planning during retirement to maximize your financial resources, minimize risks, and achieve your desired lifestyle goals. By starting now, you can address potential gaps in your retirement plan, optimize your investment strategies, and implement estate planning measures to protect your assets and provide for your family’s future. Delaying financial planning in retirement can lead to missed opportunities and increased financial vulnerability.

5. Things we do for you? Our company provides a range of services tailored to meet the unique needs of retired parents with settled kids, including:

- Retirement income planning to ensure you have a steady stream of income throughout your retirement years.

- Investment management strategies designed to preserve and grow your wealth while minimizing risk.

- Estate planning services to help you protect your assets and minimize taxes while ensuring your wishes are carried out.

- Long-term care planning to address potential healthcare needs and protect your financial security.

- Intergenerational wealth transfer strategies to help you pass on your assets and values to your children and future generations.

Ultimately, our goal is to help you achieve financial independence, peace of mind, and a legacy that reflects your values and priorities.

Are we right for you?

Find out if we’re a good match for your financial planning and investment management needs. We offer a free, no-obligation consultation to help us get to know each other. We can meet by phone, in-person, or online.