Parents of School going Kids

Are You Ready For These?

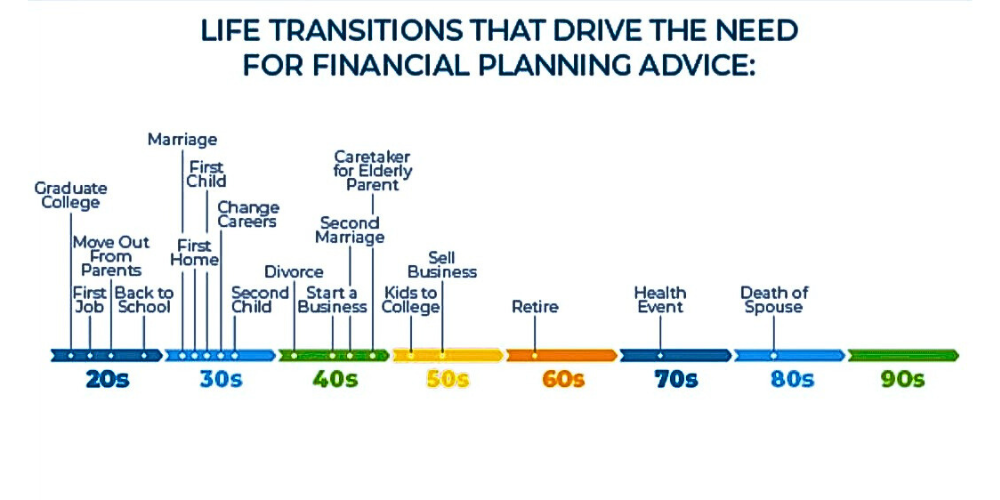

We Work With Individuals and Families in All Phases of Life.

Your personal finances and investments can become overwhelming and complex. At Sampadha, our main goal is to simplify your financial life.

1. Why you need a Financial Plan? A financial plan is essential for parents of school-going kids because it helps ensure their children’s education needs are met without compromising their own financial security. By creating a comprehensive plan, parents can budget for school fees, extracurricular activities, and other educational expenses while also saving for their own retirement, emergencies, and other financial goals. Without a plan, parents may struggle to balance competing financial priorities and risk falling short of meeting their family’s needs.

2. Why you need us? We understand that managing finances while raising school-going kids can be challenging and time-consuming. Our expertise and experience enable us to develop personalized financial strategies that align with your family’s goals and values. We provide guidance and support to help you navigate the complexities of financial planning, from budgeting for educational expenses to investing for the future. By partnering with us, you can have peace of mind knowing that your family’s financial well-being is in good hands.

3. How can we do it for you? Our company offers a range of specialized services tailored to the needs of parents of school-going kids. We start by conducting a thorough analysis of your financial situation, including income, expenses, assets, and liabilities. Based on this analysis, we develop a customized financial plan that addresses your family’s unique needs and goals, including education planning, retirement planning, risk management, and estate planning. Our ongoing support and guidance ensure that your financial plan remains relevant and effective as your circumstances change.

4. Why you need it now? It’s crucial to prioritize financial planning while raising school-going kids to ensure that you can afford their education without sacrificing your own financial security. By starting now, you can take advantage of time to save and invest for future educational expenses, maximizing the growth potential of your investments and minimizing the need for borrowing. Delaying financial planning may result in missed opportunities and increased financial stress as educational costs continue to rise.

5. Things we do for you? Our company provides a range of services tailored to meet the unique needs of parents of school-going kids, including:

- Education planning to help you save for your children’s future educational expenses, including tuition, books, and other fees.

- Budgeting and cash flow management to ensure that you can afford your children’s educational expenses while also meeting your other financial obligations and goals.

- Investment management strategies designed to grow your wealth over time while minimizing risk and volatility.

- Risk management solutions, such as insurance, to protect your family’s financial security in the event of unexpected events or emergencies.

- Estate planning services to help you protect and distribute your assets according to your wishes and provide for your children’s future.

Ultimately, our goal is to help you achieve financial independence, peace of mind, and a bright future for your children through sound financial planning and prudent decision-making.

Are we right for you?

Find out if we’re a good match for your financial planning and investment management needs. We offer a free, no-obligation consultation to help us get to know each other. We can meet by phone, in-person, or online.