Newly or Getting Married

Are You Ready For These?

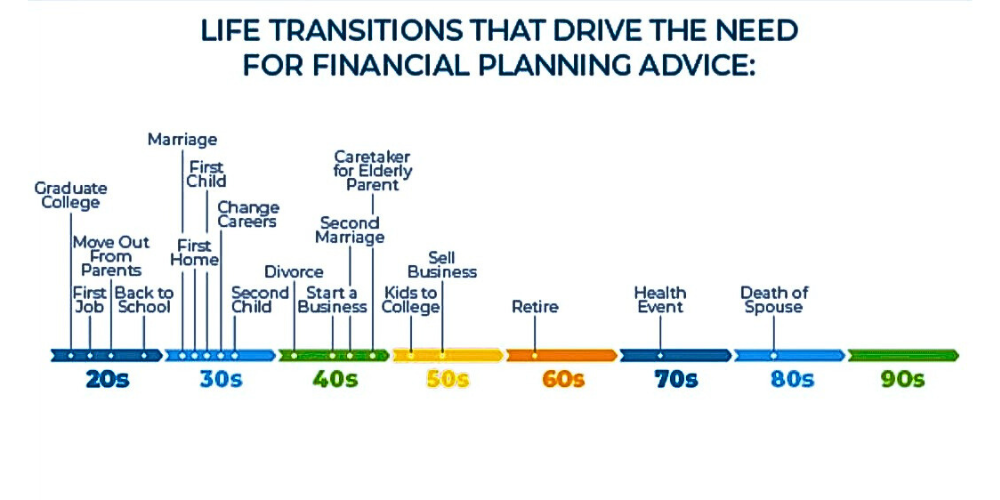

We Work With Individuals and Families in All Phases of Life.

Your personal finances and investments can become overwhelming and complex. At Sampadha, our main goal is to simplify your financial life.

1. Why you need a Financial Plan? A financial plan is crucial for newlyweds or those getting married because it sets a roadmap for achieving your shared financial goals. It helps you align your spending, saving, and investing strategies to ensure financial stability and security as you build your life together. Without a plan, it’s easy to become overwhelmed or make impulsive financial decisions that can negatively impact your future.

2. Why you need us? We understand that managing finances can be complex and overwhelming, especially during significant life transitions like getting married. Our expertise and experience allow us to navigate the intricacies of financial planning efficiently and effectively. We provide personalized guidance and tailored solutions to help you achieve your financial goals while minimizing stress and uncertainty.

3. How can we do it for you? We have a team of dedicated financial professionals who will work closely with you to understand your unique financial situation, goals, and priorities. Through comprehensive analysis and strategic planning, we’ll develop a customized financial plan that addresses your short-term needs and long-term aspirations. Our ongoing support and guidance ensure that your plan remains relevant and adaptable as your circumstances change.

4. Why you need it now? It’s essential to prioritize financial planning early in your marriage to establish a solid foundation for your future together. By starting now, you can proactively address any financial challenges or opportunities that arise, setting yourselves up for long-term success and security. Delaying financial planning can lead to missed opportunities and increased financial stress down the line.

5. Things we do for you? Our company provides a range of services to support your financial journey as a newly married couple. This includes:

- Developing a comprehensive financial plan tailored to your unique goals and circumstances.

- Providing guidance on budgeting, saving, and debt management to help you achieve financial stability.

- Offering investment advice and portfolio management strategies to grow your wealth over time.

- Planning for major life events such as buying a home, starting a family, or saving for retirement.

- Regularly reviewing and adjusting your financial plan as needed to accommodate changes in your life or financial situation.

Ultimately, our goal is to empower you to make informed financial decisions that align with your values and aspirations, allowing you to enjoy a secure and prosperous future together.

Are we right for you?

Find out if we’re a good match for your financial planning and investment management needs. We offer a free, no-obligation consultation to help us get to know each other. We can meet by phone, in-person, or online.